With the economy up in the air due to inflation kicking into high gear, war, interest rates rising, and other factors that we can’t control we decided it would be great to see how other marketers are reacting.

And we didn’t want to know how marketers were reacting just in the U.S., we wanted to know on a global scale what businesses of all sizes in all major industries (and for both B2B and B2C) are doing.

So, at my ad agency, NP Digital, we decided to leverage our traffic, email lists, and relationships to conduct a wide survey so not only could see what other marketers are doing but to also understand the “why” behind their decisions.

Here’s what we found out.

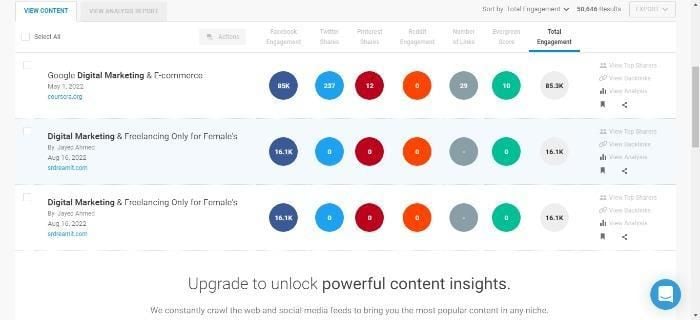

Earned Media

Let’s look closely at each earned media channel to see how budgets are being reallocated.

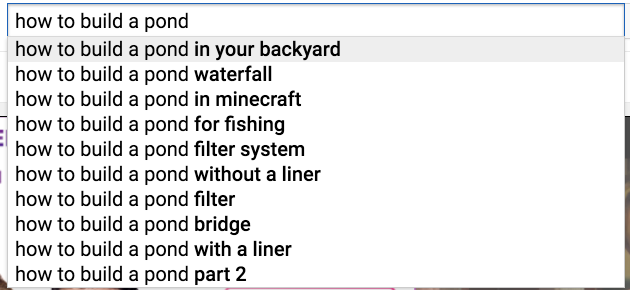

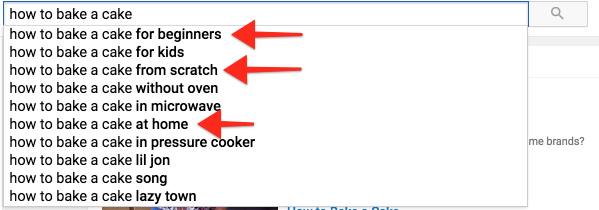

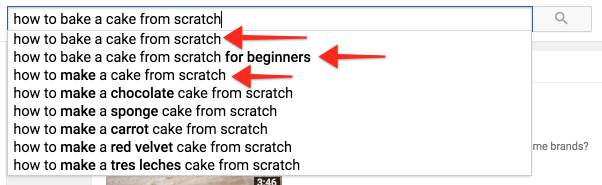

SEO

68% of companies surveyed said they are increasing their SEO budget. The number 1 response on why they are making this is shift is because they said it provides a higher ROI than paid advertising. Which is true… it just takes longer to see results.

11% said they would maintain their SEO budget going into 2023. The number 1 response on why is because there wasn’t much flexibility with their overall marketing spend due to economic reasons.

As for the 21% that said they were decreasing… it was a toss-up on why between two main responses.

The first was that SEO wasn’t producing results and the second was that the marketing team is having to make cuts to meet their reduced budget.

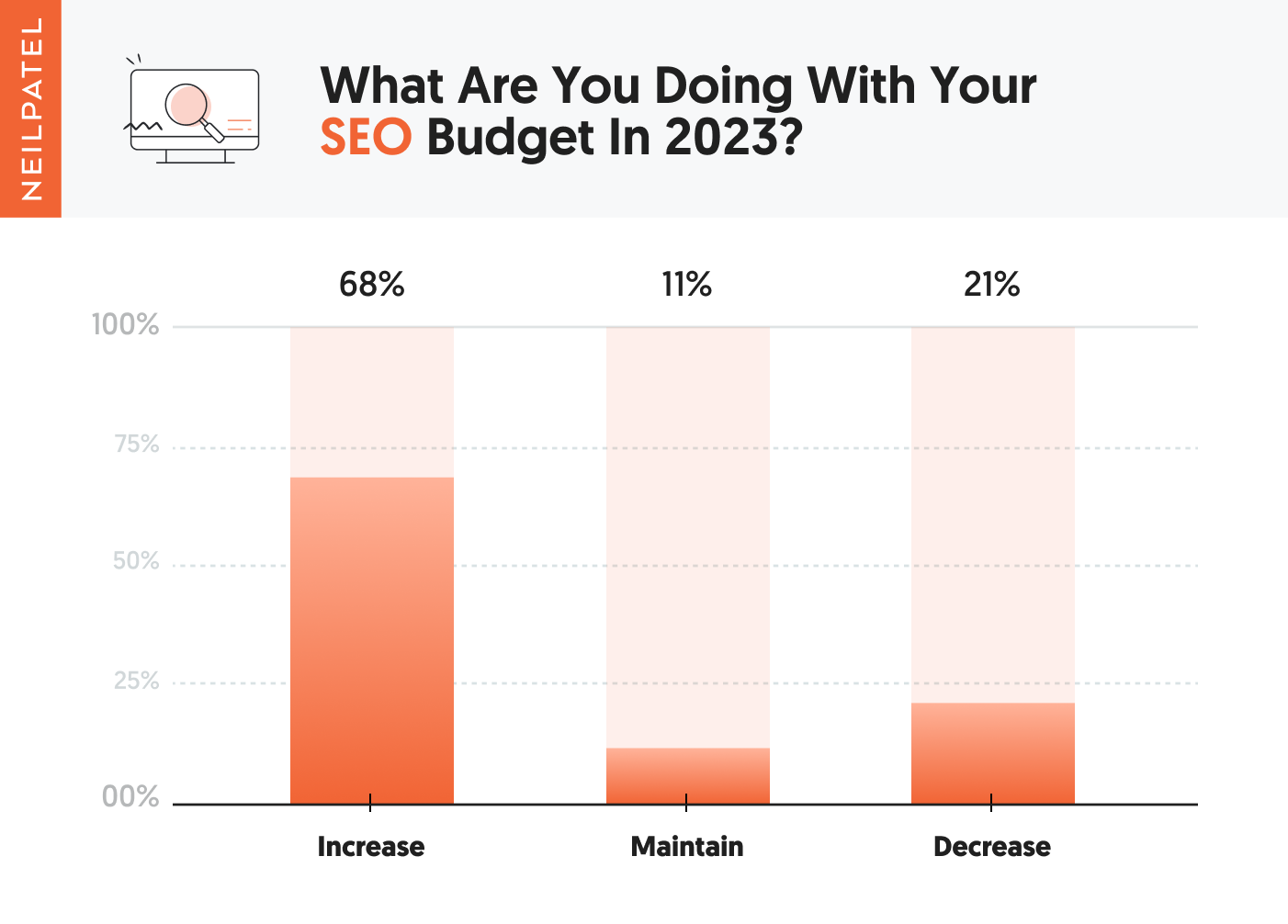

Organic Social Media

32% of companies are planning on increasing their organic social media budget. The primary response was because of the Apple IOS changes, and they aren’t able to spend as much as they want on paid social media.

26% said they would keep their budget as is with the main reason being that you have to be on the major platforms in order to communicate with customers and potential customers.

A whopping 42% said they would decrease due to organic reach continually declining and organic social media not providing as high of an ROI as it used to.

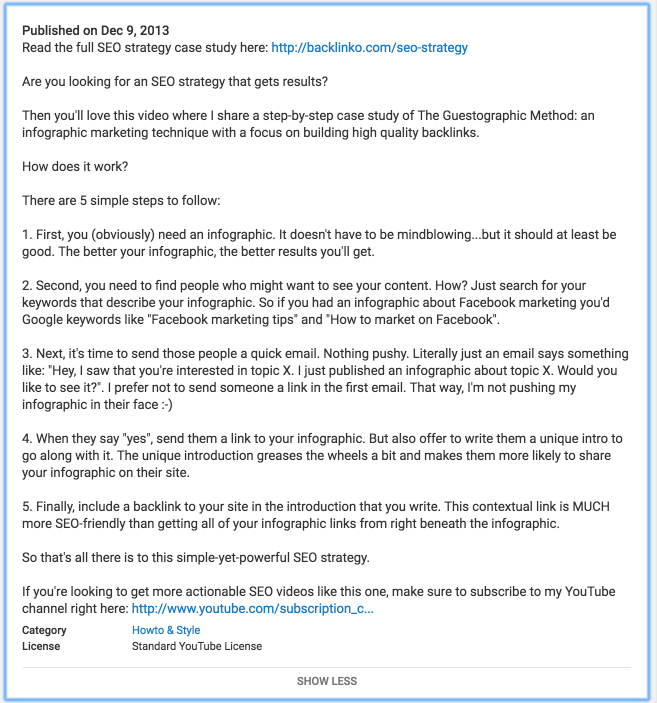

If you are facing a decline in organic reach, watch this:

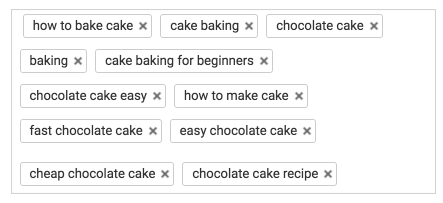

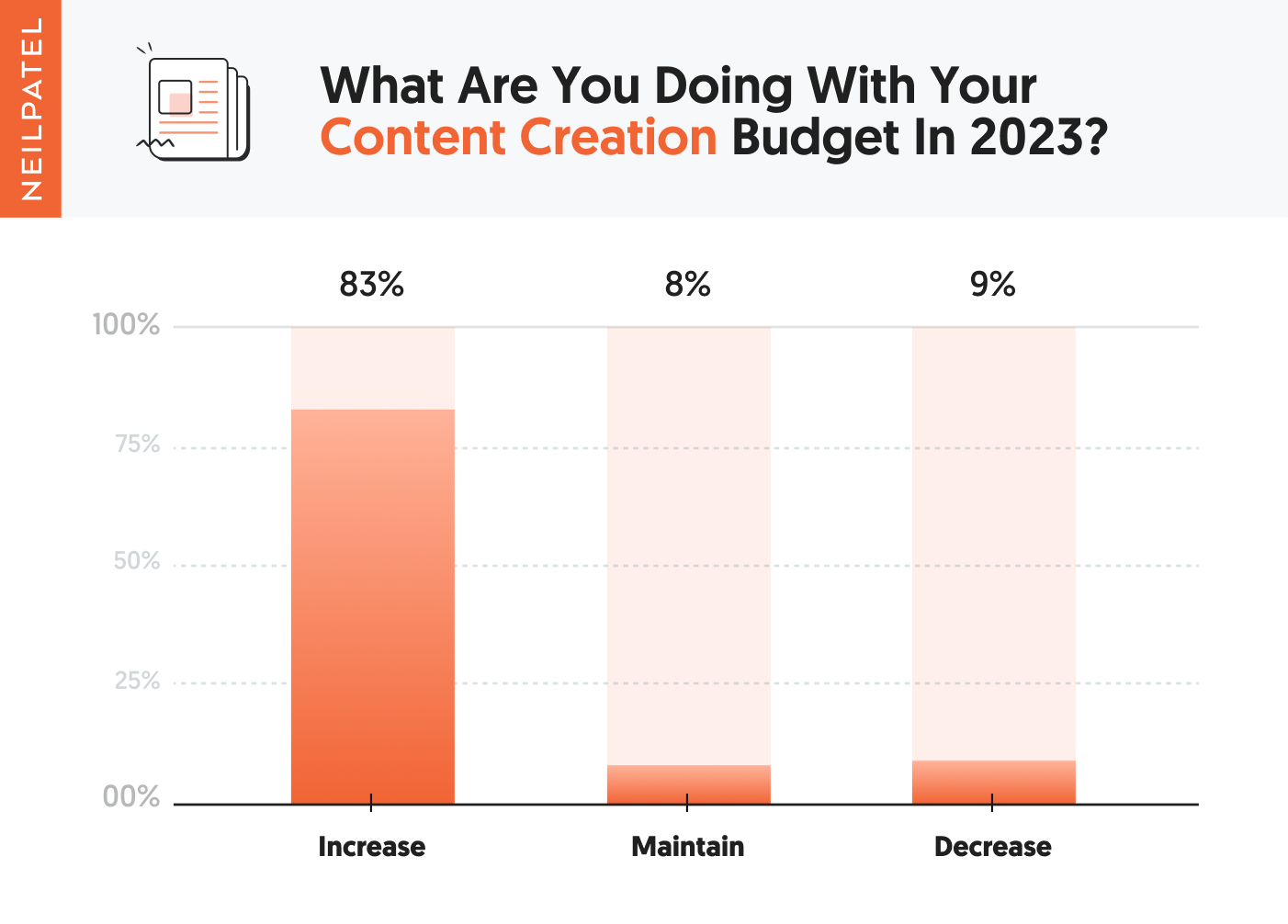

Content

83% of companies are increasing their content production budget. The number 1 response on why was due to the need to create content in multiple formats including video and the cost associated with it.

8% said they would maintain their budget. The main reason why was the economic situation limiting their ability to spend more.

And 9% said they are decreasing their content creation budget due to AI tools helping them create content more affordably.

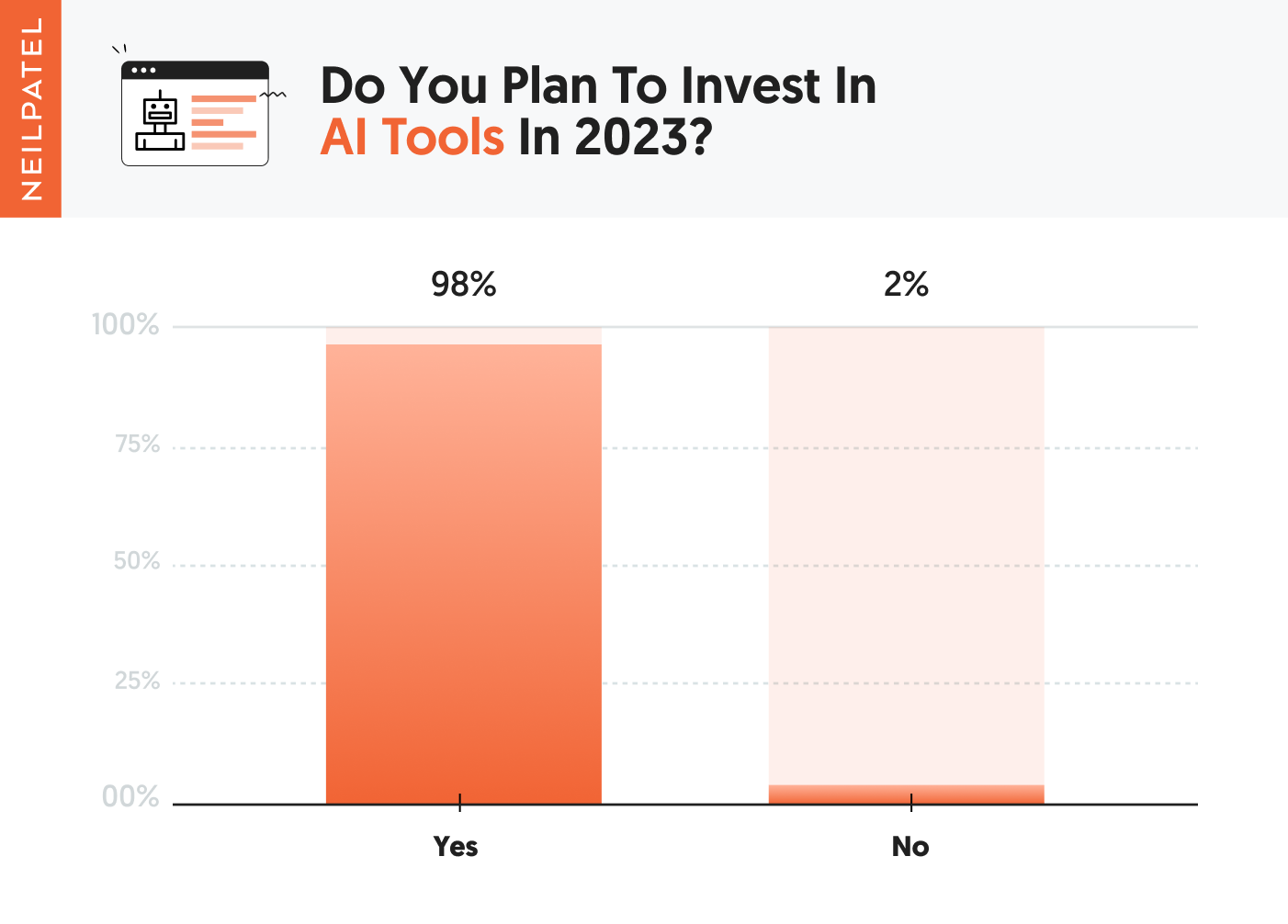

AI Tools

Speaking of AI tools… they are the talk of the town these days. From GTP-3 to Dall-E to ChatGPT… there are a lot of companies leveraging these APIs to create their own tools or to make their marketing more efficient. Especially with earned media.

A staggering 98% said they would invest in AI tools in 2023. The main reason why revolved around these 3 main points:

- Save money by automating content creation

- Reduce the amount of time spent on creating content

- Ability to reduce headcount in the content department

2% said they would not test out AI tools, and the main reason was they felt that the quality of the AI tools isn’t up to their standards.

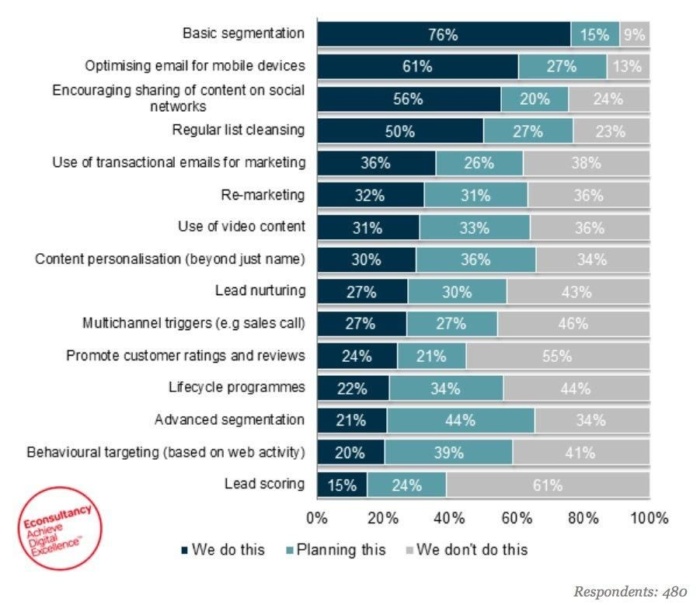

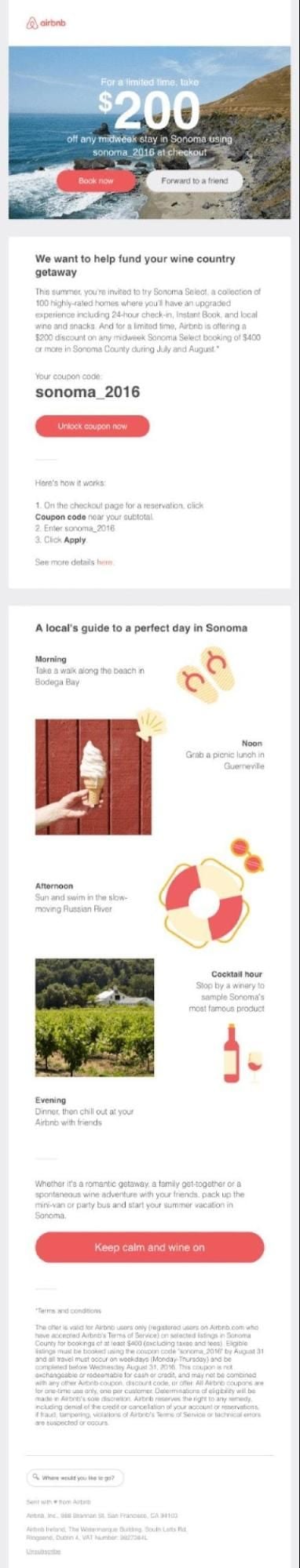

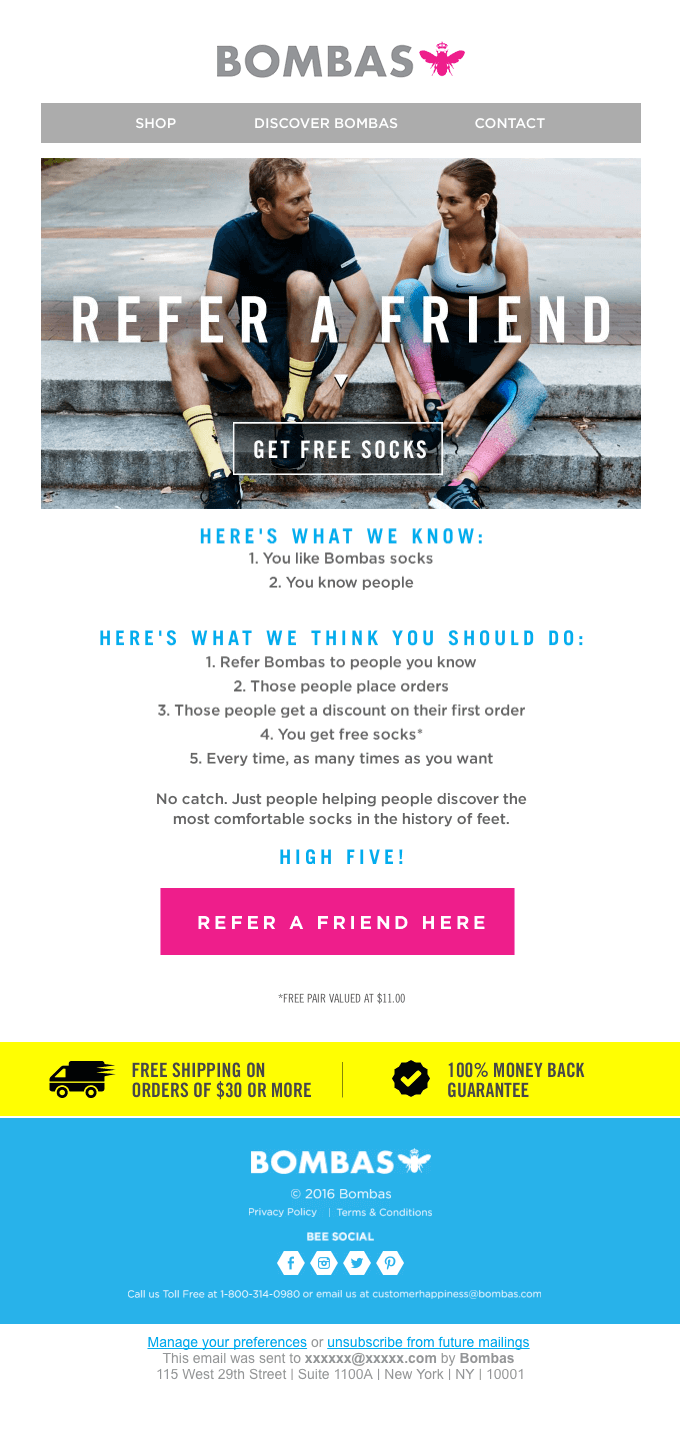

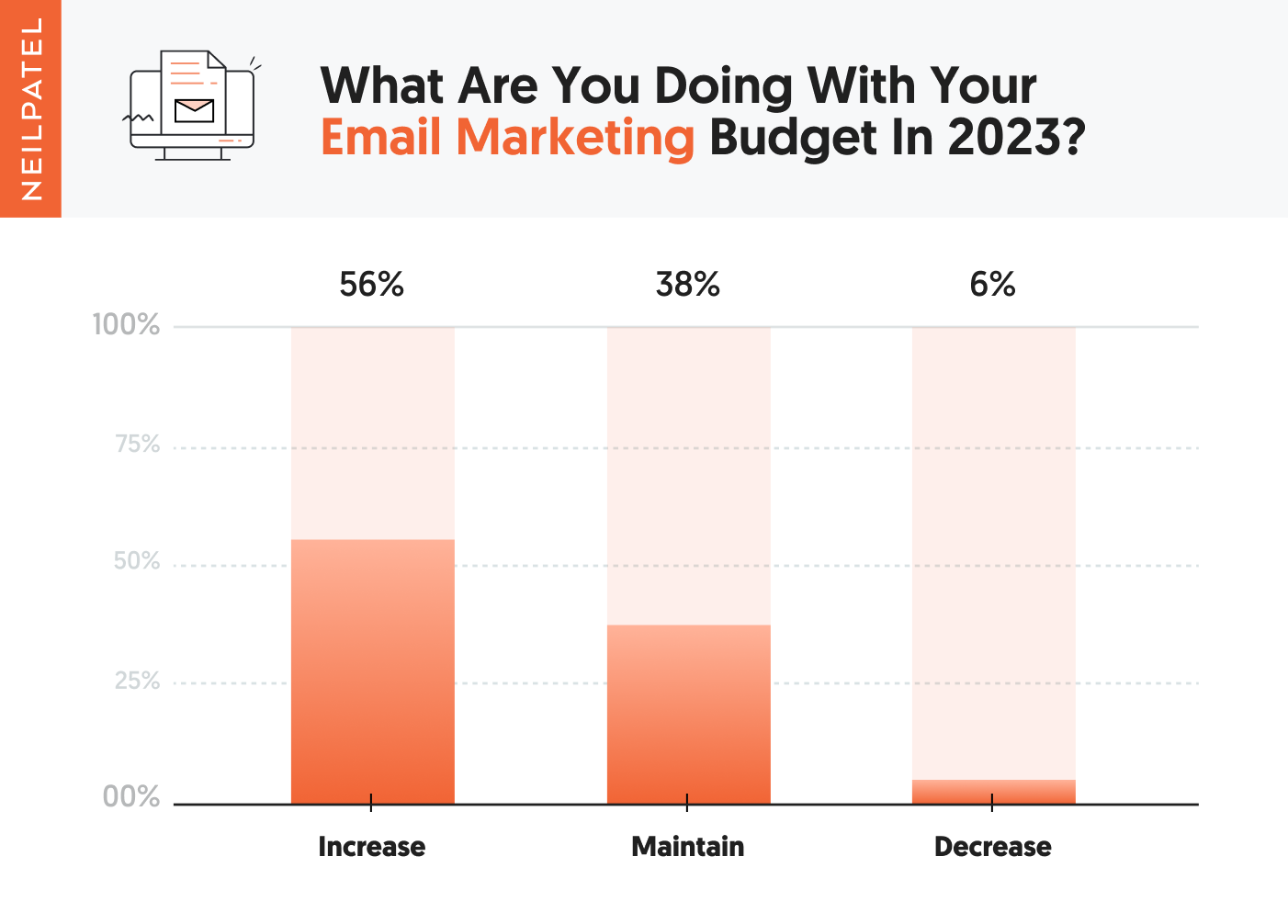

Email Marketing

56% of companies said they would increase their email marketing budget. It was a toss-up on why marketers said they would increase their budget…

- Because their list size is growing so their costs for housing email addresses are going up

- Due to privacy laws, companies are spending more to make sure they are compliant with personal data

- Companies are investing more in marketing automation

38% of companies plan on maintaining their email marketing efforts. The main response why was they believed email is an important channel to use to communicate with existing and potential customers.

6% said they plan on decreasing their email marketing budget. There were 2 main responses on why marketers said they would decrease their budget… it was between

- Companies pruning their email list of inactive subscribers which would allow them to save money

- Companies are switching email marketing software providers to save money

Very few companies planned on reducing headcount related to email marketing efforts.

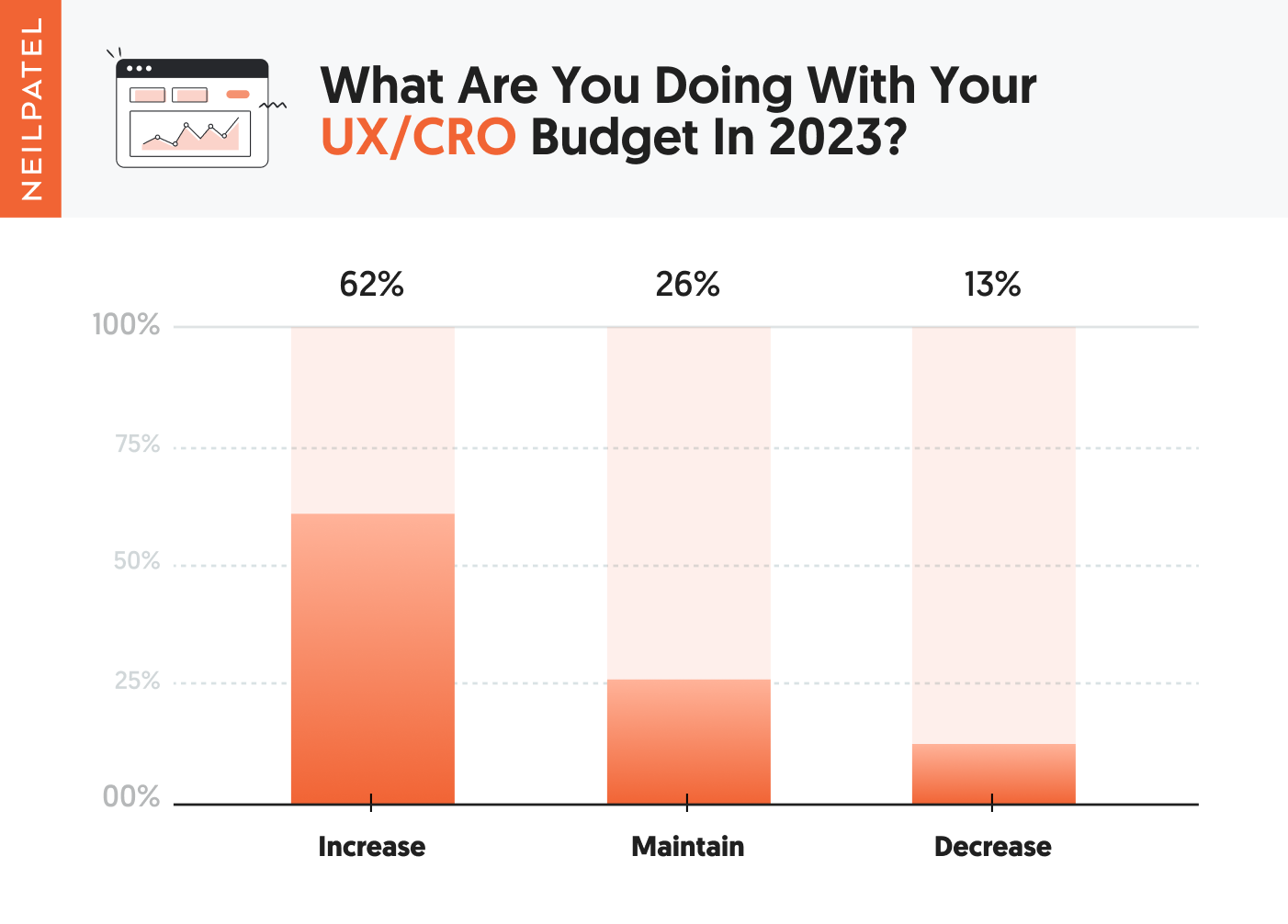

UX/Conversion Rate Optimization

61% of companies plan on increasing their overall UX/CRO budget. It was a toss-up on the main reason they wanted to increase their overall budget in this category. The reasons were:

- With the rising cost of ads, CRO helps provide a better ROI

- UX important part of the overall marketing experience

26% of companies plan on keeping their UX/CRO budget the same primarily for the same reasons as above.

And 13% plan on decreasing their budget due to economic reasons as the main driver.

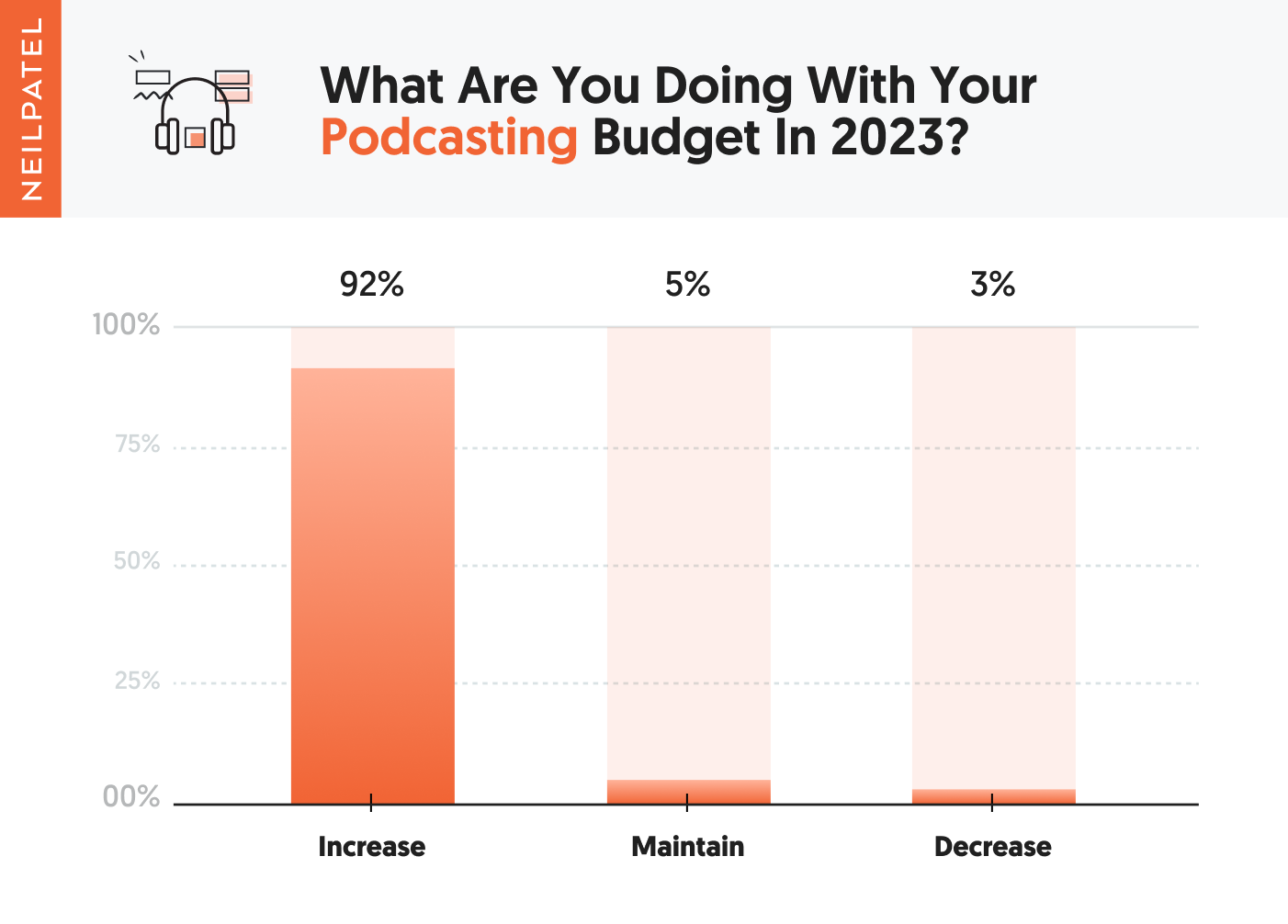

Podcasting

Podcasting is one of those marketing channels that isn’t saturated yet. And the survey results show that marketers believe in it as a viable channel for the future.

92% of companies are planning to increase their podcasting budget in 2023. The main response was that they currently don’t have a podcast and are planning on creating one.

5% of companies are planning on maintaining their existing podcasting budget. The main response on why is they haven’t figured out how to drive meaningful revenue from their podcast so they don’t want to spend too much yet.

And 3% plan on decreasing their podcasting spend. The main reason was due to economic factors requiring marketing to make cuts.

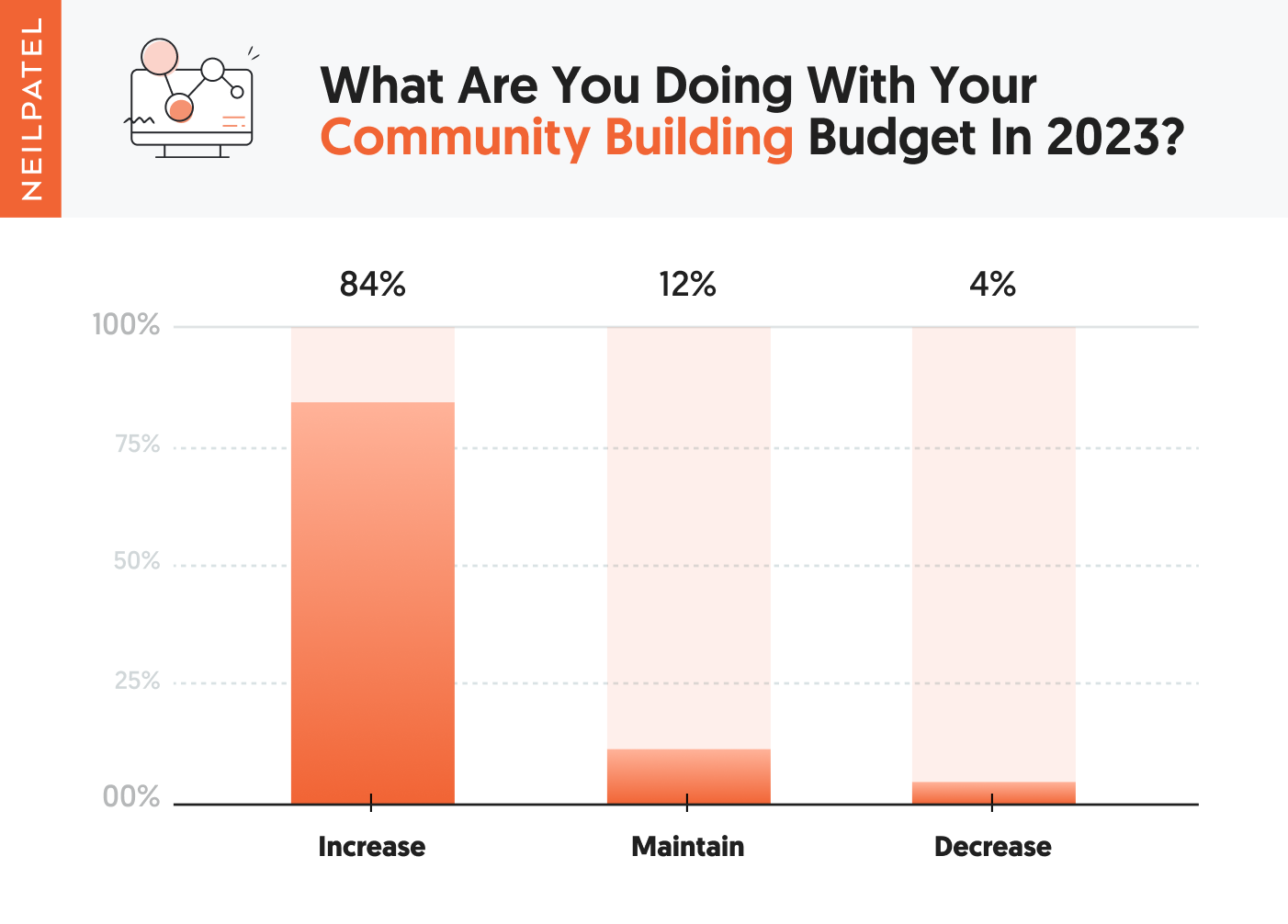

Community-Building

84% of companies are increasing their spend on community building. The main reason was that marketers want to feel more in control of their destiny instead of being beholden to algorithms that they can’t control.

12% of companies plan to maintain their community building. The majority of the companies in this category felt it was important to increase their budget but they weren’t able to due to economic reasons.

And 4% plan on decreasing their community-building budget due to the economy.

Paid Ads

There are a lot of different paid ad channels, for this category we looked at the main leaders. So, let’s start off with search ads.

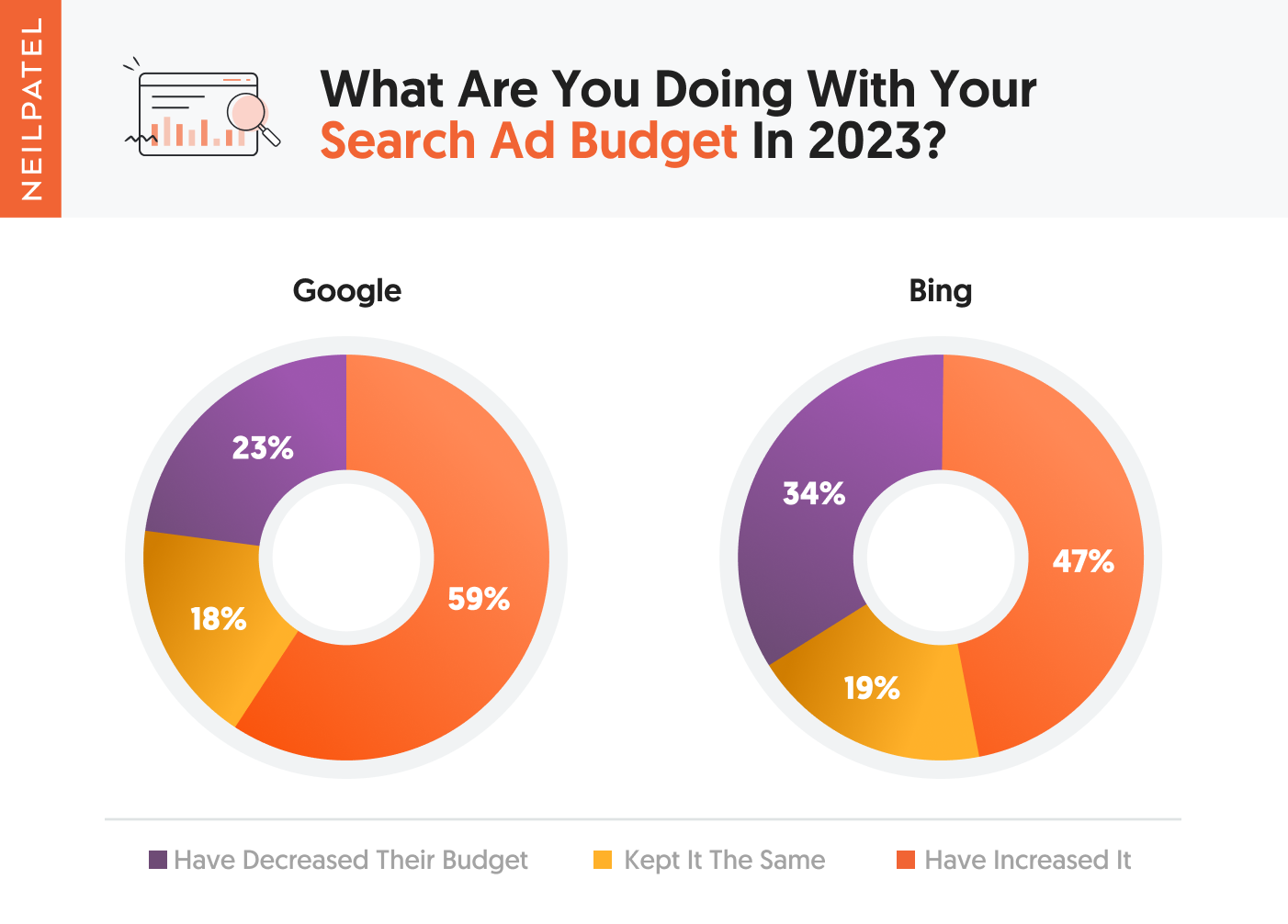

Search Ads

With Google and Bing ads, most companies (59% and 47% respectively) are looking to increase their budgets. Almost all of the responses on why were that it provided a clear ROI compared to other marketing channels.

Both channels had roughly the same percentage for maintaining the budget at 18% for Google and 19% for Bing. The main response for maintaining the budget was they haven’t figured out how to scale while maintaining profit margins.

And as for the decreases (23% for Google and 34% for Bing), the main responses were related to:

- The average cost per click for their industry is getting cheaper

- Fewer people were searching for the keywords they were bidding on so their overall spend is decreasing.

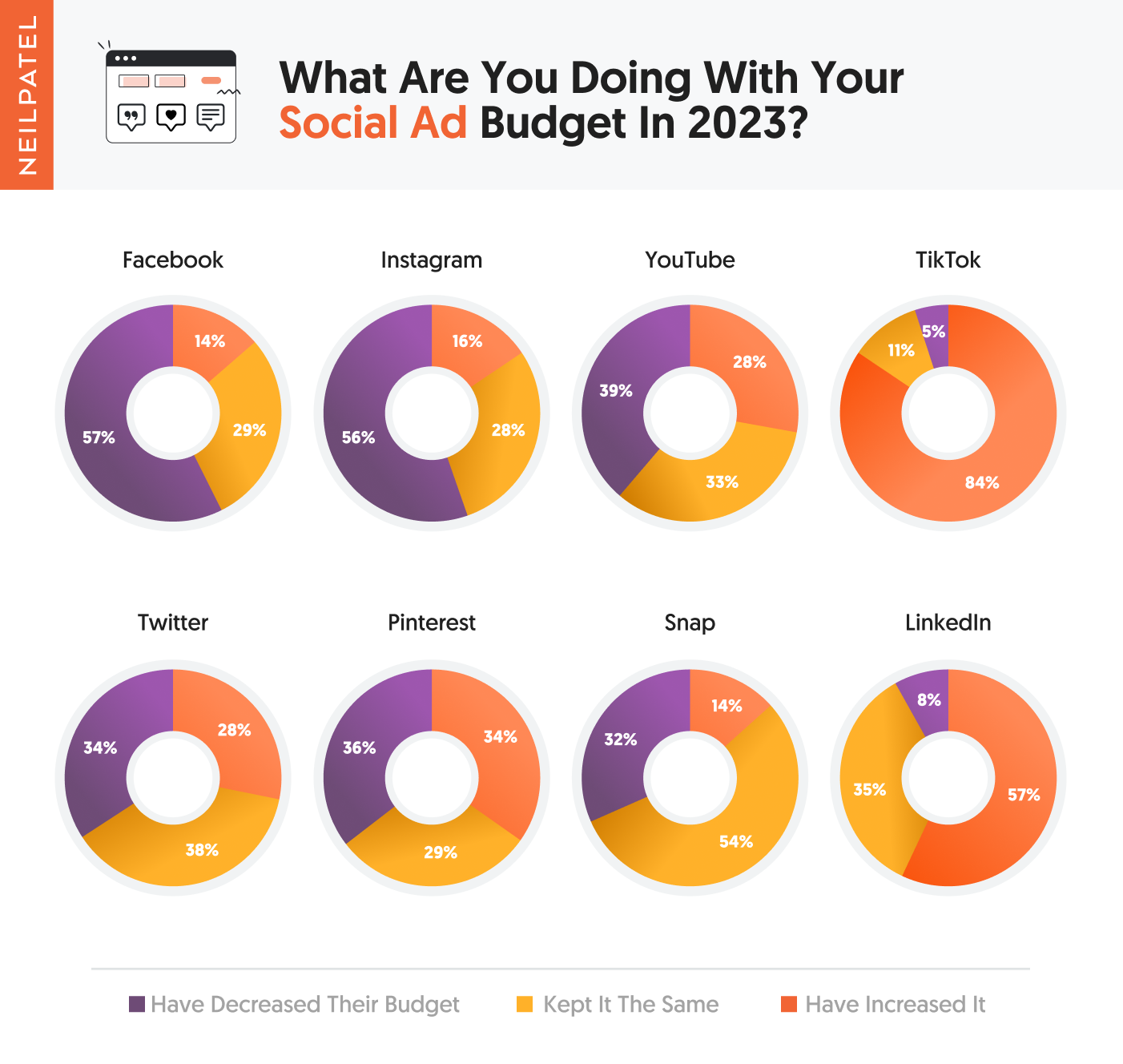

Social Ads

The percentages in the graph above are all over the place, but the story is consistent when you look at the responses.

With Facebook, Instagram, and Snap, the main responses for either maintaining or decreasing spend are related to the Apple IOS privacy changes. In other words, marketers aren’t able to generate the same ROI from Facebook as they used to be able to.

Some of the companies got lucky and were able to maintain their spend to generate a similar ROI and some had to decrease their spend in order to keep their ads profitable… again due to IOS privacy changes.

A smaller percentage on these 3 platforms were able to increase their budgets. The main response to increasing is that their campaigns are profitable so they plan on scaling.

As for YouTube and Pinterest, (28% and 35% respectively) said they planned on increasing their budgets. The main response was their ads are profitable and they want to scale them.

33% (YouTube) and 29% (Pinterest) plan to maintain their ad spend because their ads are profitable. The second most popular response for maintaining was they can’t scale due to it making the ads unprofitable.

As for the decrease in YouTube and Pinterest ad spend, the main response was related to the economy impacting their business and budget cuts in marketing.

With Tiktok, the majority of marketers, at a whopping 84%, said they plan to increase their overall spend on this platform because they see it as an untapped opportunity.

And with LinkedIn, the majority of the companies who responded about their LinkedIn ad spend were in the B2B category. 57% plan on increasing their budget with the number 1 response being that they feel it is the best platform to target their ideal customer.

35% plan on maintaining their LinkedIn ad spend with the main reason being that it is working but they aren’t able to scale due to a lack of inventory for their target demographic.

And 8% plan on decreasing their LinkedIn ad spend with the primary response being due to their company slowing down for economic reasons.

Now I wanted to save the most interesting one for last, which is Twitter. I didn’t actually expect these results… and you’ll see why…

28% of companies plan on increasing their Twitter ad spend. The number one response on why was they feel there is an opportunity to acquire customers for less on the platform due to companies pulling out after Elon bought them.

And 34% plan on decreasing their ad spend. When asked why the main response was they don’t agree with how Elon Musk is running the platform and the changes he has been making.

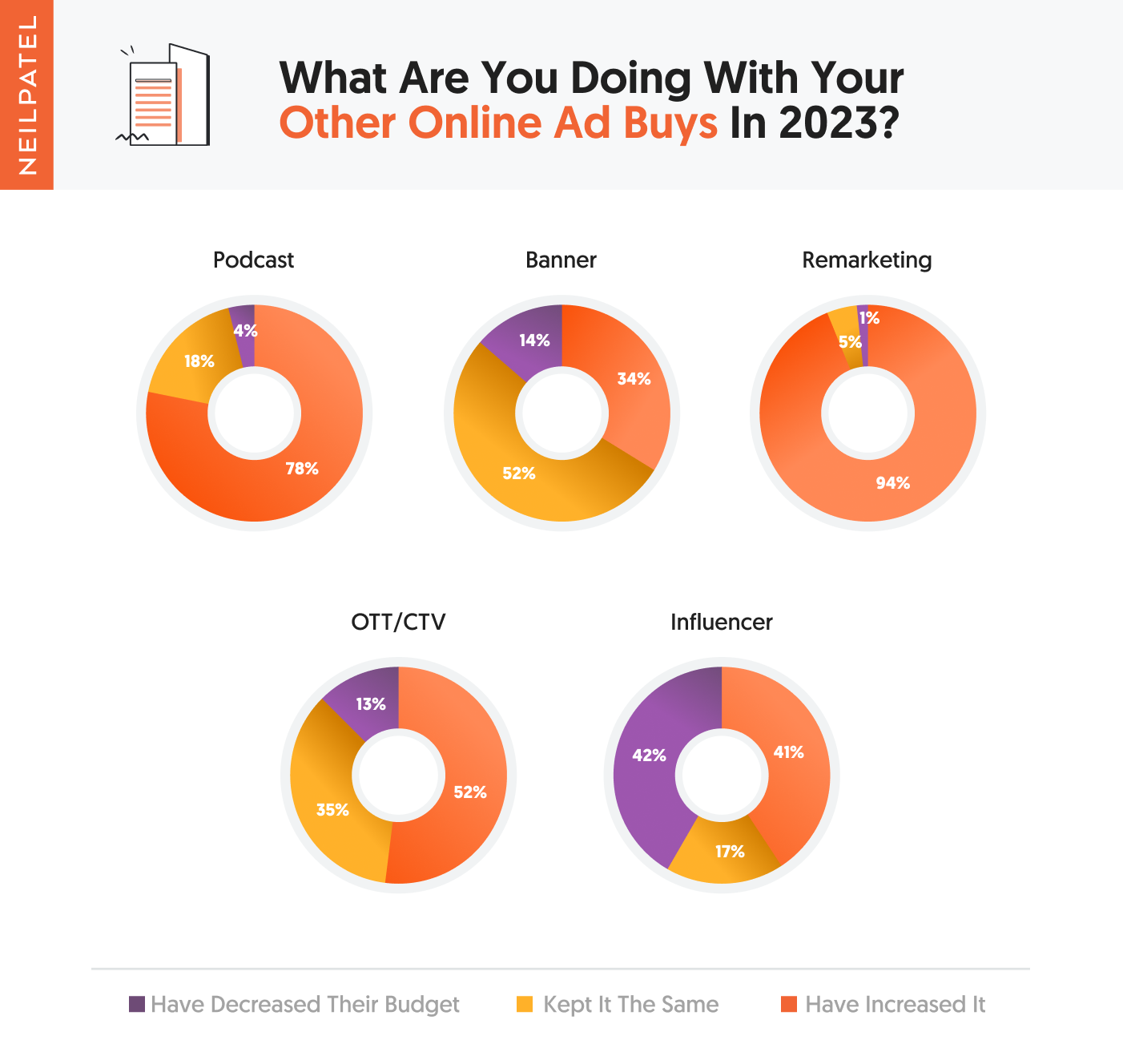

Other Online Ad Buys

Let’s dive into each of the channels as the responses were interesting.

With podcast ads, 78% plan on increasing their ad spend. The top reason was they plan on buying ads to promote their own podcast in order to make it more popular. 18% plan on maintaining their ad spend with the responses primarily discussing how it produces a positive ROI or that companies felt it was great for branding and cheaper than radio.

With the 4% of respondents saying they are decreasing their ad spend, the primary reason was that they are seeing a decrease in ROI from their podcast ad spend.

For banner ads, 34% plan on increasing their ad spend with the main response being it’s profitable and they want to scale it. 52% plan on maintaining their spend with the main reason being around it being profitable. And 14% of companies plan on decreasing their ad spend due to mainly not being as profitable as they would like.

As for remarketing spend, 94% plan to increase their ad budget as they see it as one of their most profitable marketing channels. 5% plan on maintaining it as it is profitable. And 1% plan on decreasing their remarketing ad spend with the main reason being around lack of conversions.

Now for OTT/CTV… if you aren’t familiar with these terms, it’s related to streaming TV.

52% of companies plan on increasing their ad spend for OTT/CTV with the main reason being it provides more transparency and trackability than traditional TV ads. 35% plan on maintaining their spend for this category with the main responses being related to it providing great branding and or profitability.

As for the 13% that plan on decreasing their spend, the main reason was shifting the budget to Google ads and other channels that are more profitable.

Now looking at influencer marketing, which is mainly used by eCommerce companies, 41% plan on increasing their spend with the main reason being is it provides a better ROI than other marketing channels that they are using.

17% plan on maintaining their spend with the main response being that it is profitable and cutting it would cause the company to lose money.

And funny enough 42% plan on decreasing their influencer marketing ad spend with the main response being that they aren’t able to produce a positive ROI.

If you look at the percentages you can clearly see influence marketing is either working for companies or isn’t. Roughly 58% of the companies that use this tactic are able to do so profitably.

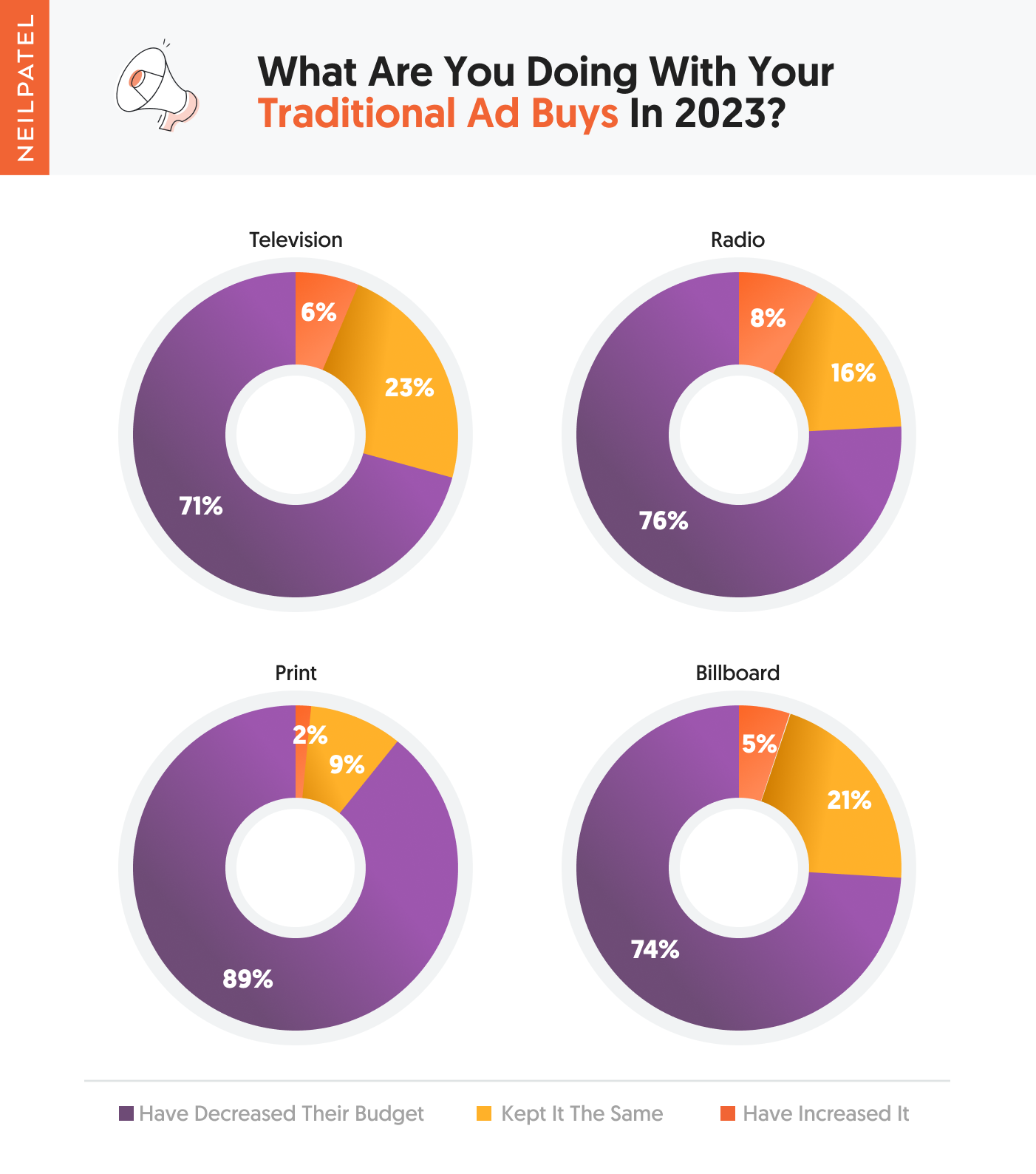

Traditional Ads

With traditional ads, there was a big trend. In almost all channels companies responded with their plan to decrease traditional ad spend.

It was a toss-up with a few reasons. The main ones being:

- Lack of ability to track return on investment

- Economy causing marketing budget cuts

- A shift toward moving ad spend to performance marketing due to better results.

A lot of companies are still maintaining their budgets and when we dug through the responses very few companies are stopping their traditional ad spend all together as they still believe it is an important channel to reach their customers.

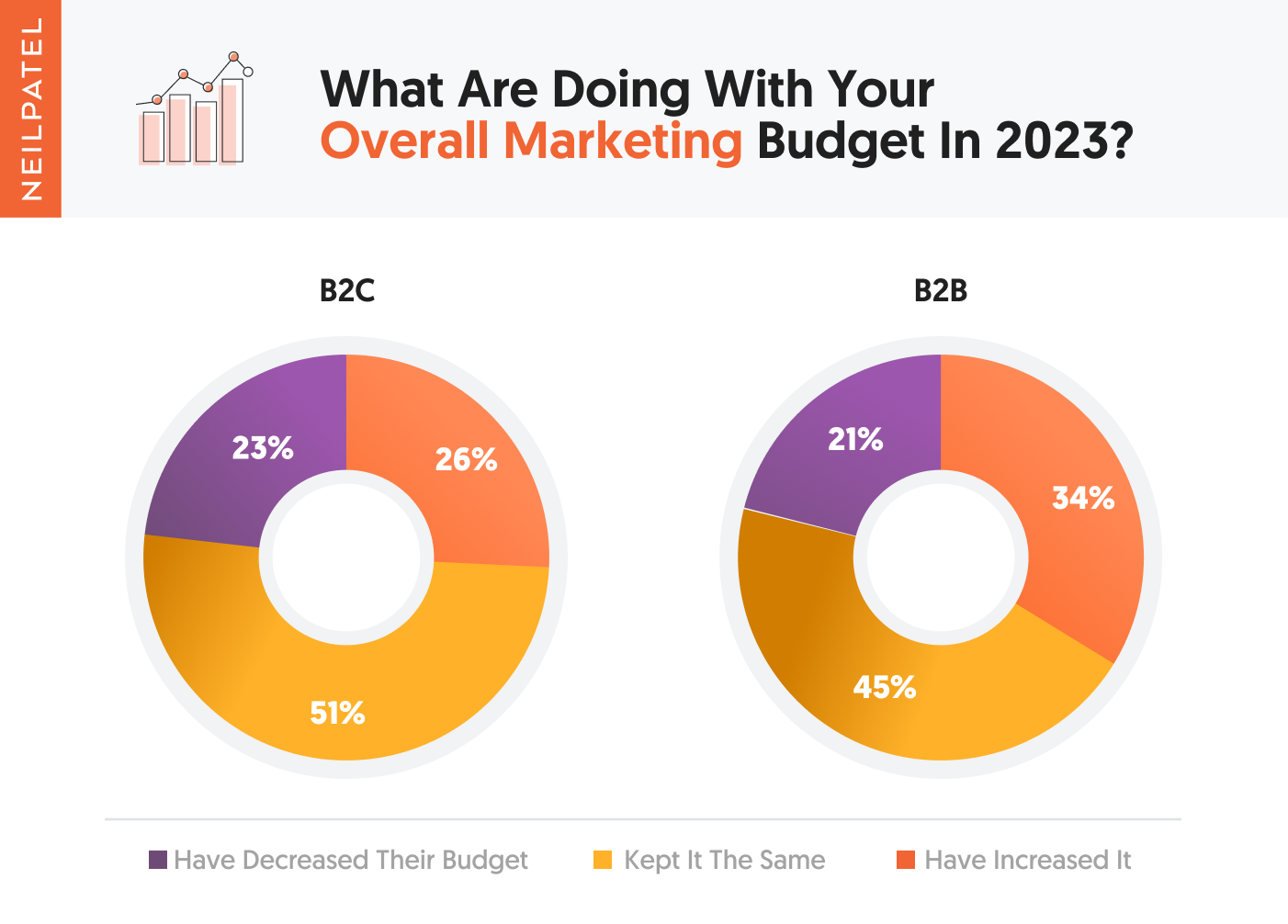

Overall Marketing Budget

As you saw from all the graphs above there are a lot of budgets shifting around.

But we wanted to also know what companies are doing with their overall marketing budget. Are they increasing… decreasing?

I assumed with the economy a lot of companies would be decreasing their spend, but overall more companies are increasing them in both B2C and B2B than decreasing.

26% of B2C companies plan on increasing their spend, 51% plan on maintaining their spend, and only 23% plan on decreasing their spend.

The main responses for increasing or maintaining their spend revolved around their marketing either being profitable or just overall working.

As for the decreases, most of the reasoning was around the economy and how it is already impacting their business.

As for B2B, a lot of the companies in this category have recurring revenue and much more predictability into future quarters when it comes to financial performance.

34% of them plan on increasing budgets with the primary reasoning being their marketing is profitable or at least when looked at from a lifetime value perspective. 45% plan to maintain with the above reasoning being the primary driver as well.

And 21% of B2B companies plan on decreasing their overall marketing spend due to the economy impacting the company’s overall health.

Conclusion

Even though most marketers are worried about the economy and are making changes to their marketing, the majority of them are increasing their spend or maintaining versus reducing.

From an earned media perspective most companies are looking to increase their budget due to it providing a higher ROI, other than organic social with the primary reason being organic reach is continually declining.

And with AI tools becoming the latest craze, most marketers are at least trying them out.

From a paid ads perspective, most companies are planning on increasing or maintaining their search ads. But with social ads, many companies are planning to decrease. Not because of choice, but due to IOS privacy changes impacting the performance of their ads and companies not being able to scale their social ads as profitably as they use to.

Funny enough with it comes to Twitter it’s a bit polarizing as 28% of companies are planning on increasing ad spend because 34% of companies are planning on decreasing or stopping their ads due to their views on Elon Musk and the decisions he has made.

As for traditional ad buys, in all channels, the majority of companies are planning on decreasing their ad spend and shifting a lot of the money to performance channels like Google Ads or SEO which is more trackable.

So now that you know what others are doing, real question is, what are you doing with your marketing budgets in 2023?

from Neil Patel https://ift.tt/ABhqS4L

via IFTTT